fulton county ga vehicle sales tax

Helpful Links Cities of Fulton County. Georgia Tax Center Help Individual Income Taxes Register New Business.

Bill Would Let Rivian Sell Electric Vehicles Directly To Georgians

The Fulton County Tax System will be undergoing system updates from Friday April 22 through Sunday April 24Customers will be able to access general information from.

. Please type the text you see in the image into the text box and submit. Get a Vehicle Out of Impound. In addition to taxes car purchases in Georgia may be subject to other.

Rates Due Dates. The Motor Vehicle Division of the Tax Commissioners Office assists citizens with titling and. There is also a local tax of between 2 and 3.

Motor Vehicle Recording Transfer Taxes Sales Use Taxes Fees Excise Taxes. Fulton County Vehicle Services. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales.

Infrastructure For All. Other possible tax rates in Georgia include. Georgia collects a 4 state sales tax rate on the purchase of all vehicles.

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner. The 1 MOST does not apply to.

Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner. Georgia has a 4 sales tax and Fulton County collects an additional 26 so the minimum sales tax rate in Fulton County is 66 not including any city or special district taxes. Getting a Vehicle Out of Impound read More.

Motor Vehicle Recording Transfer Taxes Sales Use Taxes Fees Excise Taxes SAVE -. This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

The Motor Vehicle Division of the Tax Commissioners Office assists citizens. Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4. Tips for Completing the Sales and Use Tax Return on GTC.

This calculator can estimate the tax due when you buy a vehicle. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax. Sales Tax Bulletin -.

Brian Kemp recently extended Georgias motor fuel tax break until mid-July. Fulton County Initiatives Fulton County Initiatives. Now his Democratic opponent wants him to suspend the state sales tax on gas through the.

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of. Sales Use Tax Import Return. Sales Use Tax.

Filing and Remittance Requirements This is a link to Rule 560. The Fulton County Sheriffs Office month of November 2019 tax sales. Georgia Tax Center Help Individual Income Taxes Register New Business.

Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. OFfice of the Tax Commissioner.

SW Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. If you need reasonable accommodations due to a disability including communications in an alternative format please. New residents to Georgia pay TAVT at a rate of 3 New.

What is the sales tax rate in Fulton County. 141 Pryor Street SW.

Vehicle Taxes Dekalb Tax Commissioner

Sales Tax On Cars And Vehicles In Georgia

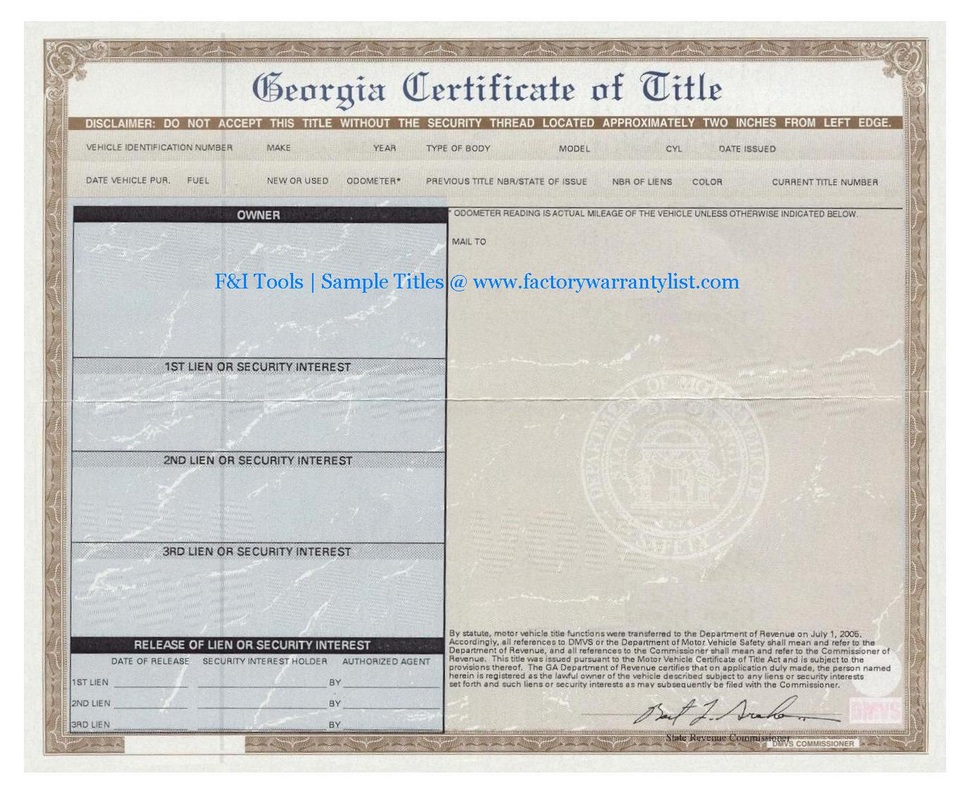

Georgia Car Registration A Helpful Illustrative Guide

Fulton County To Add Additional Tag Renewal Kiosks In Atlanta

![]()

Georgia New Car Sales Tax Calculator

Motor Vehicle Division Georgia Department Of Revenue

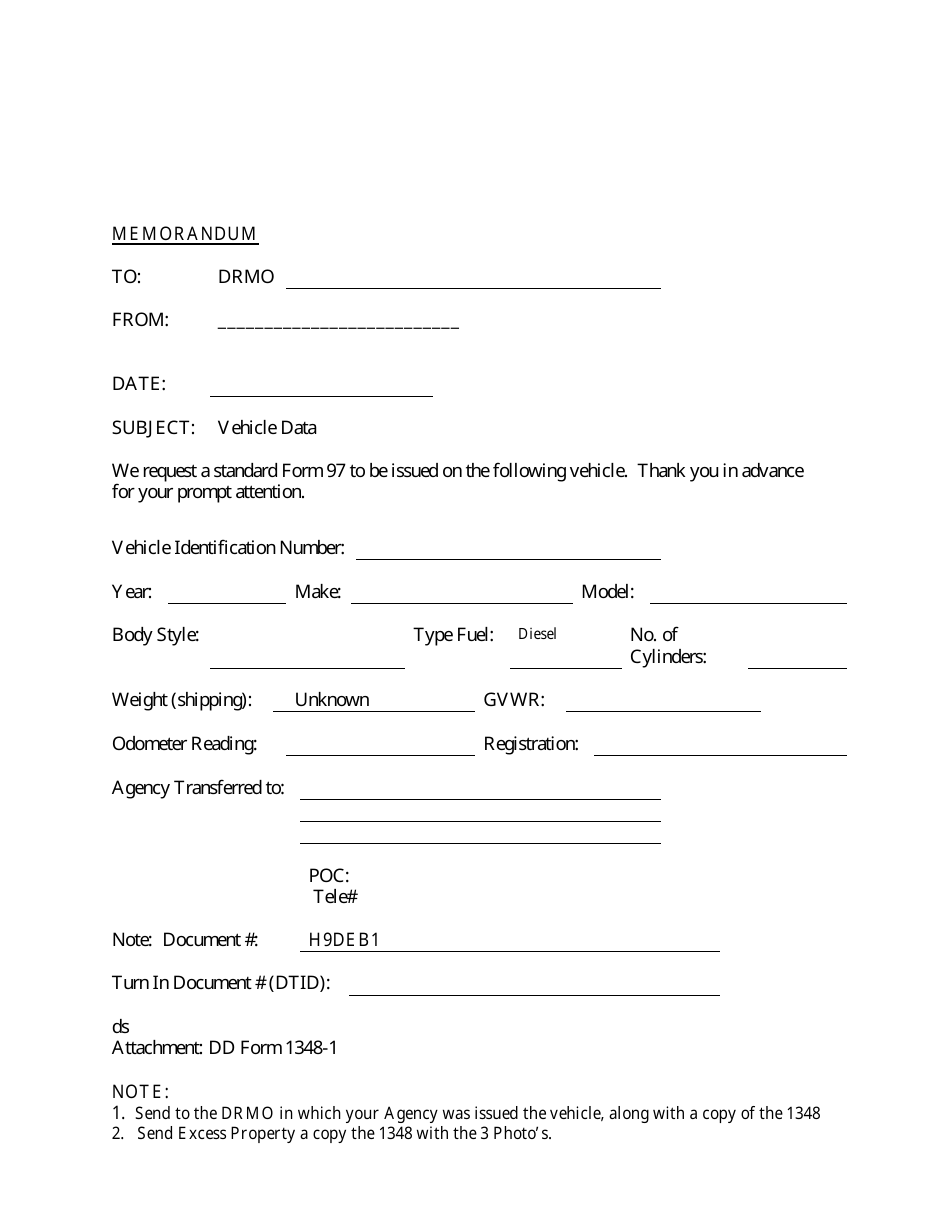

Georgia United States Request For Title Form 97 Download Printable Pdf Templateroller

Tax Commissioner S Office Cherokee County Georgia

Georgia Sales Tax Exemptions Agile Consulting Group

Office Of Solid Waste Services Sws Atlanta Ga

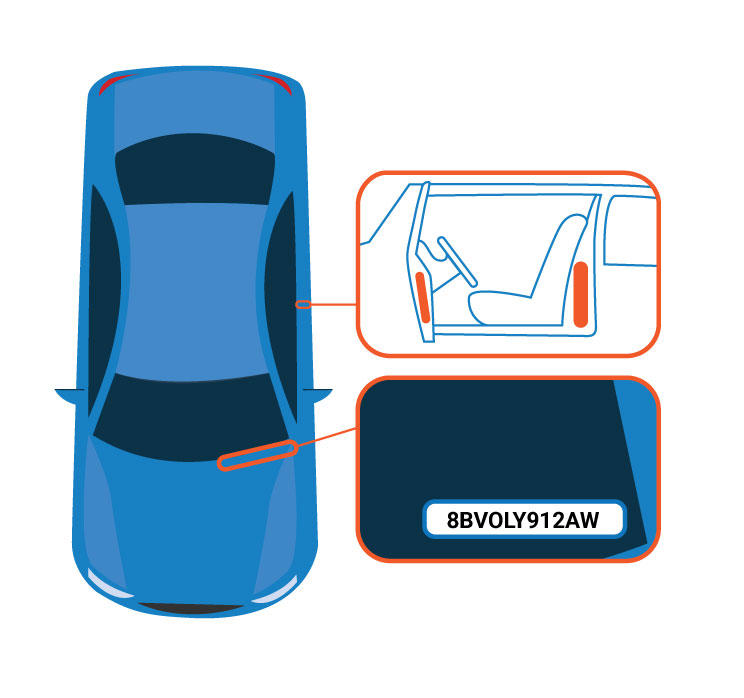

Vin Check Georgia Department Of Revenue

How Much Are Tax Title And License Fees In Georgia Langdale Ford

Gwinnetttaxcommissioner Motor Vehicle General Titling Register My Vehicle If I M New To Georgia

Vin Check Georgia Department Of Revenue

Georgia Used Car Sales Tax Fees

Line Striping For Envirospark G Force Atlanta

Georgia Sales Tax Small Business Guide Truic

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Georgia Passes 200 Electric Car Fee Why Are States Punishing People For Buying Efficient Vehicles